Mortgage Rates Today: Your Ultimate Guide to Current Interest Rates and Trends

Are you planning to buy, refinance, or switch mortgages? With mortgage rates fluctuating constantly, it can be overwhelming to navigate the complex world of interest rates. In this comprehensive guide, we'll break down the current state of mortgage rates, their impact on borrowers, and the trends that are shaping the industry. Whether you're a first-time homebuyer or a seasoned expert, this article will provide you with the essential insights to make informed decisions about your mortgage.

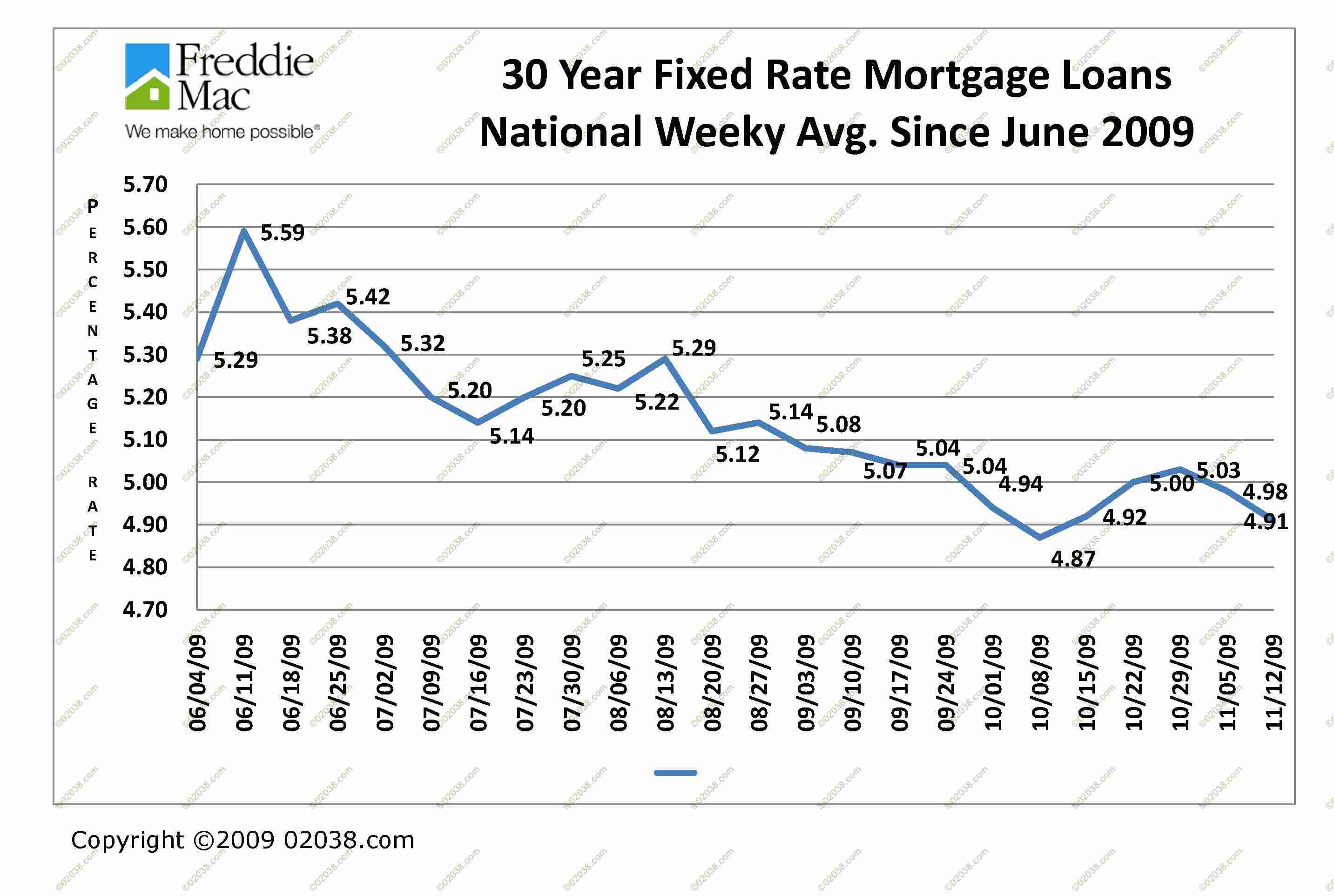

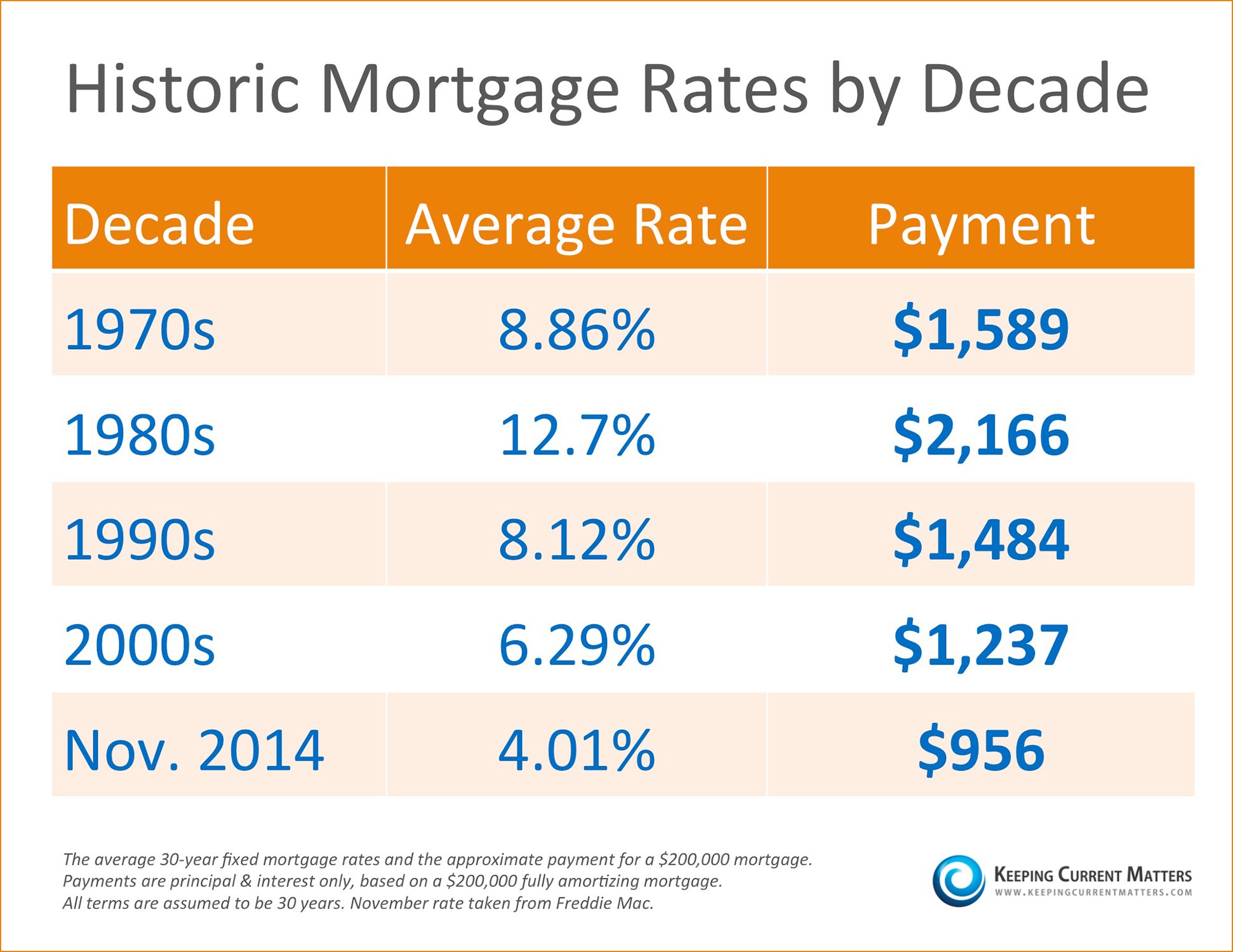

The current mortgage landscape is characterized by low interest rates, which have been trending downwards over the past few years. According to recent data from Freddie Mac, the average 30-year fixed-rate mortgage rate has hovered around 3.75% in recent months. This decrease in rates has made borrowing more affordable for homebuyers, prompting a surge in home sales and refinancing activity. On the other hand, the rising costs of living, inflation, and global economic uncertainty have sparked concerns about potential rate hikes in the future.

Understanding the Factors that Influence Mortgage Rates

Mortgage rates are influenced by a complex array of factors, including:

• Economic Indicators: The state of the economy, employment rates, inflation, and GDP growth all impact the federal funds rate, which is the benchmark interest rate set by the Federal Reserve. When the economy is strong, the Fed may raise the funds rate to curb inflation, leading to higher mortgage rates.

• Market Conditions: Changes in global markets, interest rates, and government policies can influence the mortgage market. For instance, a strong US dollar can lead to higher mortgage rates due to increased borrowing costs.

• Monetary Policy: Central banks' decisions to adjust interest rates and quantitative easing policies also impact mortgage rates. For example, the European Central Bank's recent rate cuts have supported bond markets and mortgage rates.

• Government Policies: Local and national government policies, such as tax laws and regulations, can affect mortgage rates. For instance, changes in property taxes or tax deductions can impact the affordability of homes.

Current Mortgage Rates: A Breakdown by Type

Here's a summary of the current mortgage rates, including rates for different types of mortgages:

- 30-year fixed-rate mortgages: The average rate has remained steady around 3.75%, making it an attractive option for borrowers who plan to stay in their homes for the long term.

- 15-year fixed-rate mortgages: With an average rate of 3.25%, this option offers a lower interest rate for a shorter term, making it suitable for borrowers who want to pay off their mortgage quickly.

- 5/1 adjustable-rate mortgages: The average rate for this type of mortgage has increased to 3.75%, reflecting the rising costs of living and inflation.

- Adjustable-rate mortgages (ARMs): These mortgages have variable rates that can fluctuate over time. The average rate for ARMs has increased to 3.25%, offering a lower rate for borrowers who want flexibility in their mortgage payments.

Trends in Mortgage Rates

The current mortgage landscape is characterized by several trends:

• Low rates persist: Despite some speculation about rate hikes, the current low-interest rate environment is expected to continue for the foreseeable future.

• Refinancing activity surges: The falling rates have prompted many borrowers to refinance their existing mortgages, leading to an increase in refinancing activity.

• Mortgage rates may rise in the future: As the economy continues to grow, the Federal Reserve may raise interest rates to curb inflation, leading to higher mortgage rates.

• Government-backed loans remain popular: Government-backed loans, such as FHA and VA loans, continue to be popular among homebuyers, offering favorable terms and lower down payments.

How to Compare Mortgage Rates

With so many mortgage options available, it can be challenging to compare rates. Here are some tips to help you find the best mortgage rates:

• Check multiple lenders: Research and compare rates from multiple lenders, including online banks, credit unions, and traditional mortgage companies.

• Shop around for quotes: Request quotes from at least three lenders and compare their offers to find the best rate and terms.

• Consider your credit score: Your credit score can impact the interest rate you qualify for. Aim for a credit score of 700 or higher to secure the best rates.

• Be prepared to act fast: The best mortgage rates can change quickly, so be prepared to act fast when you find a favorable offer.

Tips for Homebuyers

If you're a homebuyer, here are some tips to keep in mind when searching for mortgage rates:

• Act quickly: The best rates can change quickly, so don't wait too long to apply.

• Be prepared to provide documentation: Lenders will require documentation, such as pay stubs and bank statements, to verify your income and creditworthiness.

• Consider working with a mortgage broker: Mortgage brokers can help you navigate the complex mortgage market and find the best rates.

• Don't be afraid to negotiate: Some lenders may be willing to negotiate rates or offer better terms to secure a sale.

Tips for Refinancers

If you're a refinancer, here are some tips to keep in mind when searching for mortgage rates:

• Assess your financial situation: Consider your income, expenses, and credit score to determine if refinancing makes sense for you.

• Shop around for quotes: Research and compare rates from multiple lenders to find the best option for your situation.

• Consider cash-out refinancing: If you need to tap into your home's equity, consider a cash-out refinancing option to access the funds.

• Be aware of closing costs: Refinancing can come with closing costs, which can add up quickly. Factor these costs into your decision.

Conclusion

Mortgage rates today

Michael Mando Partner

Demet Zdemir

Marvin Agustin Wife

Article Recommendations

- Nikki C

- Sam Kass Wedding

- Google Places Rank Tracking

- Matthew Gray Gubler Controversy

- Marietemara

- Rita Faez

- Camilla Araujod Of

- Sabrina Banks Fans

- Ava Baroni

- Kyla Yesenosky